Get the free form d 422

Show details

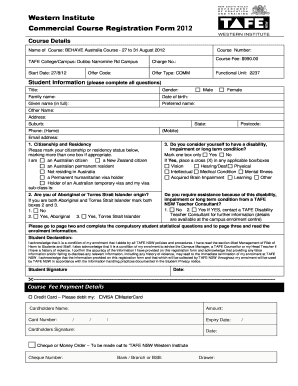

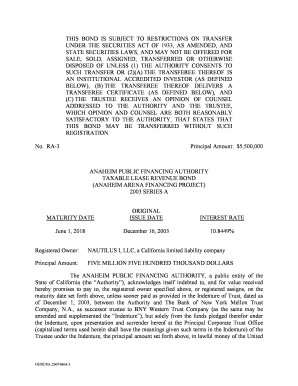

Form D--422 1998 NORTH CAROLINA DEPARTMENT OF REVENUE (Rev. 12--98) UNDERPAYMENT OF ESTIMATED TAX BY INDIVIDUALS Name(s) shown on tax return Social Security Number Instructions Who Should Use This

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nc form d 422

Edit your d 422 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form d422 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nc d422 online

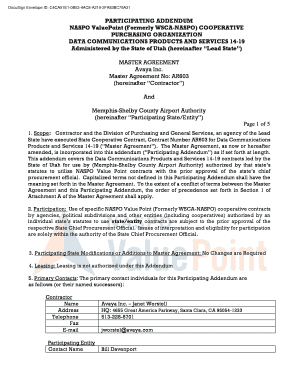

To use the professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit nc d 422 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

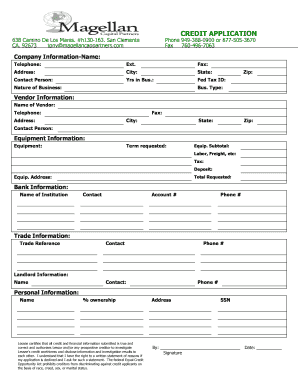

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form d 422?

Form D-422 is a document used by the United States Department of Defense (DoD) to verify and document an individual's medical condition or physical disability. It is known as the "Physical Evaluation Board Narrative Summary" form. This form is typically used during the process of evaluating military service members or veterans for possible medical retirement or disability benefits. It includes information about the individual's medical history, diagnosis, treatment, and the impact of the medical condition on their ability to perform military duties.

Who is required to file form d 422?

There is no specific form called "Form D 422." Therefore, it is not possible to determine who is required to file it. It is possible that you may be referring to a form or document related to a specific jurisdiction or context.

How to fill out form d 422?

Form D-422, also known as the Dependent Care Provider Information form, is used by employees to provide information about their dependent care providers for the purpose of claiming certain tax benefits. Here are the steps to fill out the form:

1. Download the form: Visit the official website of the Internal Revenue Service (IRS) and search for Form D-422. Download and save the form on your computer.

2. Provide your personal information: Fill in your full name, Social Security number, and mailing address. Ensure that the information is accurate and up to date.

3. Enter the dependent care provider's information: Fill in the name, address, and Social Security number or Employer Identification Number (EIN) of the dependent care provider. Include accurate details to avoid any issues with your tax benefits.

4. Specify the type of care provided: Indicate whether the care provided is for a child under age 13 or for a disabled dependent or spouse. Tick the appropriate checkbox.

5. Sign and date the form: Read the certification statement at the bottom of the form. Sign and date the form in the designated spaces to confirm the accuracy of the provided information.

6. Submit the form: Once you have completed and signed the form, keep a copy for your records and submit the original to your employer. Your employer will use the information to report the dependent care benefits you receive during the tax year.

Remember to consult with a tax professional or refer to IRS guidelines to ensure you are correctly completing the form and claiming the applicable tax benefits.

What is the purpose of form d 422?

Form D-422 is a document used by the United States Department of Defense (DoD) for reporting and documenting the annual cost of military personnel. It is known as the "Active Duty Military Personnel Strength Summary" and is used to capture information related to the number of active duty military personnel in different categories, such as officers and enlisted, by service branch, and by various demographic details.

The purpose of Form D-422 is to provide a comprehensive overview of the strength and composition of the active duty military force to assist in planning, budgeting, and resource allocation. This data is essential for the DoD to assess manpower requirements, determine workforce trends, and make informed decisions regarding recruitment, retention, and military personnel management.

The form includes information on the number of personnel within specific occupational specialties, such as combat, healthcare, and administration. It also records the number of personnel in various pay grades, including enlisted personnel and commissioned officers.

Form D-422 is generally completed and submitted annually by each component of the military, including the Army, Navy, Air Force, and Marine Corps. The compiled data is then used by the DoD to prepare reports, analyze manpower needs, and present an accurate snapshot of the military personnel strength to policymakers, legislators, and other stakeholders.

What information must be reported on form d 422?

Form D-422 is used for reporting the transfer of securities by a non-resident alien individual or foreign corporation subject to the rules and regulations of the Internal Revenue Service (IRS) in the United States.

The following information must be reported on Form D-422:

1. Identification Information: The name, address, and taxpayer identification number (or Employer Identification Number) of the transferor and the transferee.

2. Detailed Description of the Transaction: A complete description and the quantity of the securities being transferred, including the class or type of security and the CUSIP number (if available).

3. Acquisition Date and Cost Basis: The original acquisition date, the cost basis, and information about any adjustments or modifications to the basis that may be required.

4. Sales Price or Other Consideration: The total amount of cash or other consideration received by the transferor for the transfer of the securities.

5. Withholding Information: If any withholding tax was applied to the transaction, details of the withholding tax paid, including the amount withheld and any tax treaty benefits claimed.

6. Determination of Gain or Loss: Calculations of the gain or loss resulting from the transfer of securities, including any adjustments, deductions, or exemptions applied.

7. Reporting Method: Indication of the reporting method chosen (e.g., installment method, cash method, etc.) for reporting the gain or loss on the transfer.

8. Any other information required by the IRS: The IRS may require additional information not specifically listed on Form D-422, depending on the circumstances of the transfer.

It's important to note that Form D-422 should be filed with the appropriate IRS office within 20 days after the transfer of securities. Consulting with a tax professional or referring to the official IRS guidelines is advisable to ensure accurate completion of the form.

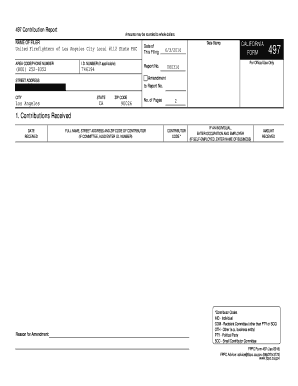

How do I complete form d 422 online?

Easy online form d 422 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How can I edit form d 422 on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit form d 422.

How do I complete form d 422 on an Android device?

Use the pdfFiller app for Android to finish your form d 422. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your form d 422 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form D 422 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.